Property Taxes in Northern Virginia and DC: What to Expect in 2025

As tax season approaches, homeowners in Northern Virginia and Washington, DC, are starting to receive their property tax assessments. Understanding how property taxes work, what changes to expect, and how to appeal an assessment can help homeowners manage costs effectively. Here’s a breakdown of what you need to know about property taxes in the Bright MLS region for 2025.

How Property Taxes Are Calculated

Property taxes are determined by two key factors:

-

Assessed Property Value – Each county or municipality assesses the value of your home, typically based on market conditions and comparable sales.

-

Local Tax Rate – Tax rates are set annually by local governments and are applied per $100 of assessed value.

For example, if a home is assessed at $600,000 and the local tax rate is $1.05 per $100, the annual property tax would be $6,300.

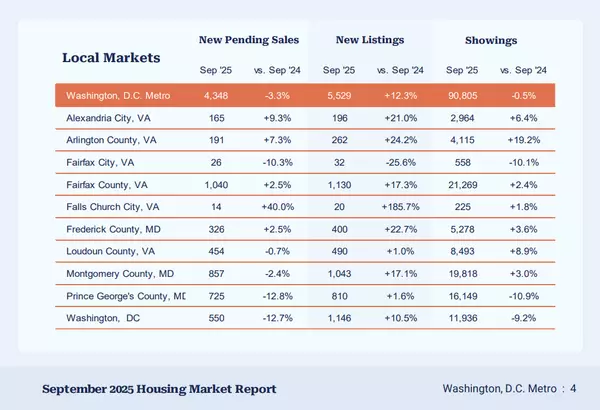

2025 Property Tax Rates Across Northern Virginia and DC

While 2025 tax rates have not been officially finalized, here’s a look at 2024 rates as a reference:

-

Fairfax County: $1.135 per $100 of assessed value

-

Loudoun County: $0.875 per $100

-

Arlington County: $1.013 per $100

-

Alexandria City: $1.11 per $100

-

Prince William County: $1.03 per $100

-

Washington, DC: $0.85 per $100 (for residential properties under $300,000, with a progressive rate structure above that)

What’s Changing in 2025?

Many local governments adjust tax rates annually based on budgetary needs and property value trends. Here are some potential trends to watch for:

-

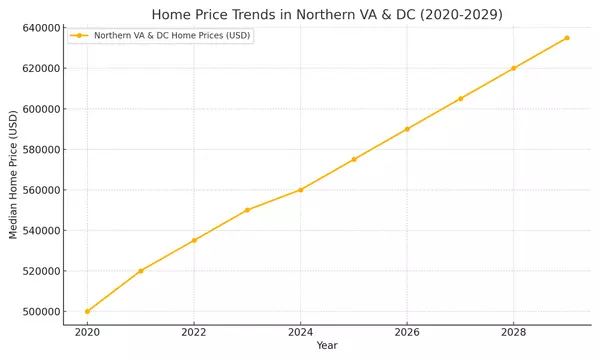

Rising Assessments: With home values increasing in many areas, assessments may go up, leading to higher property tax bills.

-

Rate Adjustments: Some jurisdictions may slightly lower tax rates to offset rising assessments, but others may increase them to support infrastructure and services.

-

Tax Relief Programs: Northern Virginia counties and DC offer various tax relief programs for seniors, veterans, and low-income homeowners. Checking eligibility for these programs can save you money.

How to Appeal a Property Tax Assessment

If you believe your property assessment is too high, you can appeal it. Here’s how:

-

Review Your Assessment Notice – Check for errors in square footage, property condition, or comparable sales.

-

Compare Nearby Sales – If similar homes in your area were assessed lower, you may have grounds for an appeal.

-

File an Appeal – Each jurisdiction has its own deadlines and procedures. In Fairfax County, for example, appeals are typically due in early April.

-

Provide Supporting Evidence – Submit documentation such as comparable home sales, property condition reports, or independent appraisals.

Payment Deadlines and How to Pay

Each locality has different deadlines for property tax payments. Here’s a general guide:

-

Fairfax, Loudoun, Arlington, Alexandria, and Prince William Counties: Taxes are typically due in two installments, around June 5 and December 5.

-

Washington, DC: Due March 31 and September 15.

Payments can usually be made online, by mail, or in person at the local tax office.

Final Thoughts

Property taxes are an essential part of homeownership, funding schools, roads, and emergency services. Understanding how they work and staying informed on potential changes can help you plan your finances accordingly. If you have questions about your property assessment, would like some help contesting the assessment or are considering buying or selling a home in Northern Virginia or DC, feel free to reach out—I’m happy to help!

Christopher Yurko

(703) 945-4291

[email protected]

Real Estate Advisor, ABR

Engel & Volkers Washington DC

Recent Posts