Mortgage Fees: Understanding The Costs Associated With Your Loan

Navigating Mortgage Fees: Understanding The Costs Associated With Your Loan

When you’re on the hunt for your dream home, it feels like there’s a price tag attached to every step of the journey. One significant expense you’ll encounter on your path to homeownership is mortgage fees. These fees, often categorized under closing costs, are essential for finalizing your mortgage and completing the purchase of your house.

Here’s A Breakdown Of Some Common Mortgage Fees To Anticipate:

Common Mortgage Fees:

- Appraisal (Typically $450 to $650): Lenders usually require a property appraisal by a licensed appraiser. The fee can vary based on property size and loan type. It’s often paid upfront and is nonrefundable if the loan doesn’t close.

- Closing Fee (Around $300 to $600): This covers the presence of a title company representative during closing to oversee the title transfer.

- Credit Report Fee (Approximately $25 to $50): This fee is for obtaining your credit report.

- Inspection (Usually $450 to $500): While not mandatory, inspections are highly recommended. The cost is incurred before closing, and findings can influence negotiations on repairs or price reductions.

- Lender’s Title Insurance (Typically 0.5% of Purchase Price): This protects the lender in case of issues missed during the title search.

- Survey (Roughly $350 to $500): Most states mandate a property survey before loan approval.

- Title Search (Around $300 to $600): Ensures there are no encumbrances on the property.

Additional Mortgage Fees to Consider:

- Application Fee (Approximately $100): Some lenders charge this fee upon application submission.

- Attorney Fee (Ranges from $150 to $500): Required in some states for legal consultation during closing.

- Flood Certification (Typically $5 to $10): Determines if the property is in a flood zone.

- Homeowner’s Title Insurance (Average $1,000): Recommended for personal protection against undiscovered liens.

- Origination or Processing Fee (Ranges from $300 to $1,500): Covers mortgage preparation costs.

- Points (Around 1% of Total Amount Mortgaged): Lender fees to lower interest rates. Each point is about 1% of the total amount mortgaged.

- Underwriting Fee (Approximately $400 to $600): Paid for loan evaluation.

- Wire or Courier Fees (Typically $30 to $100): For overnight document delivery or wire transfers.

Disclaimer: These fees are estimates and may vary based on factors such as location, lender policies, and specific loan terms. It’s essential to consult with your lender and review all documentation carefully to understand the exact fees associated with your mortgage.

Recent Posts

Historic $41 Million Judgment Sends Message to D.C. Landlords

Virginia’s First Ritz-Carlton Branded Residences Arrive in Tysons

Northern Virginia Housing Market: What’s Really Going On Right Now (Fall 2025)

Property Taxes in Northern Virginia and DC: What to Expect in 2025

Understanding Quitclaim Deeds: What They Are and When You Need One

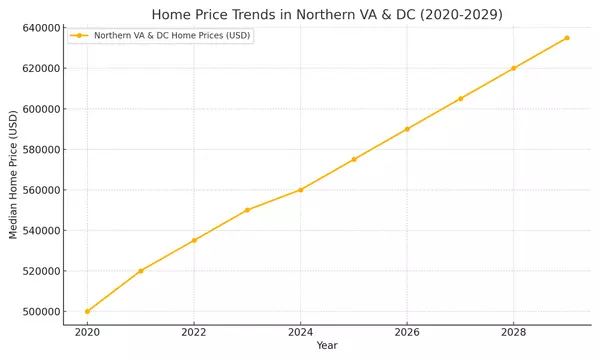

What Do the Next 5 Years of the Housing Market Look Like?

Fairfax County Making Strides Towards Affordable Housing Goal

The Essential Benefits of Having a Buyer's Agent

HOA and Condo Doc Review Period Explained

Mortgage Fees: Understanding The Costs Associated With Your Loan